When Bitcoin first entered the world in 2009 with the founding 'genesis block', only a small group of technologists could have imagined how far this grand 'crypto experiment' would come.

As someone who first learned about Bitcoin while chatting in nerdy internet forums in college, I witnessed the birth of this strange new invention that seemed almost magical - money detached from any central authority that could move seamlessly online.

One and a half decades after its birth, I'm excited that what was once only understood by cryptographers and coders has today entered the global mainstream consciousness.

Yet for many who are new to the landscape, the diversity of cryptocurrencies that now exist can be staggering – it's no longer just Bitcoin but thousands of innovative 'altcoins' and platforms, each with novel capabilities.

In this blog, I want to act as your guide across 9 major players in the crypto-verse today. We'll dig into the vision, technology, and real-world traction behind each one - from the OG Bitcoin to smart contract platforms like Ethereum to meme-powered trendsetter Dogecoin.

At Global Blockchain Solution , we aim to help you understand each protocol along with their settlement times, associated fees, and notable features. Because as much as crypto involves complex tech, the people building this future and the problems they hope to solve are what truly animate our passions.

Are you ready to dive down the crypto rabbit hole with us? It's going to be one heck of a ride!

First stop, the one and only king “Bitcoin”.

This Article Contains:

1. Bitcoin (BTC)

Market Cap: $750+ billion

As the first and most well-known cryptocurrency , Bitcoin set in motion the blockchain revolution when it was created in 2009.

Born out of the ashes of the global financial crisis, Bitcoin sought to build a decentralized peer-to-peer electronic cash system that eliminates the need for financial middlemen.

Its mysterious founder Satoshi Nakamoto (whose true identity remains unknown) released a whitepaper outlining this vision that would disrupt the world of finance and technology forever.

Pioneered Decentralized Digital Currency

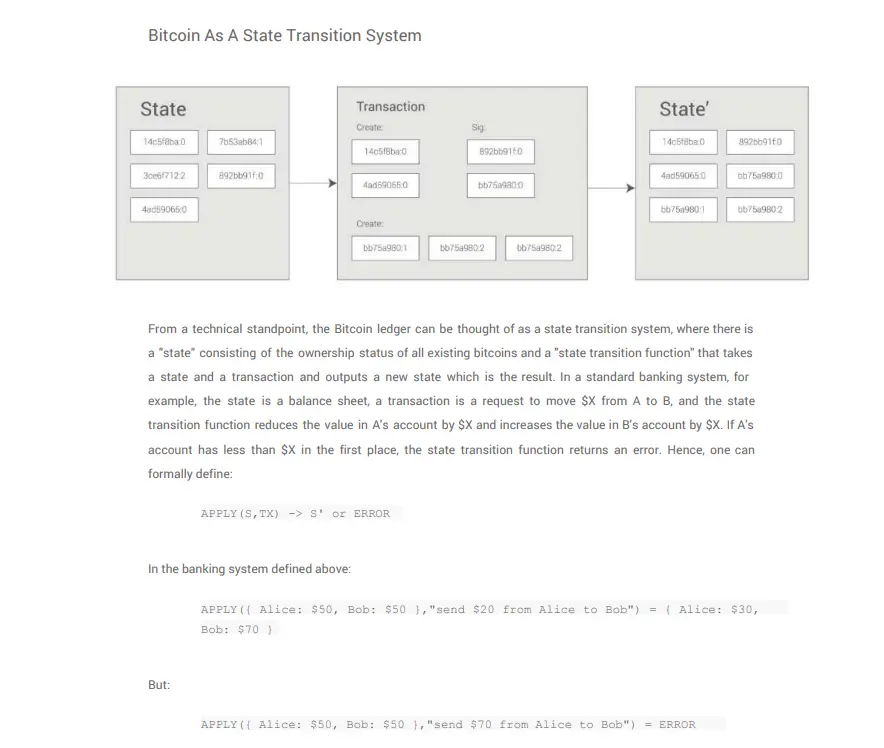

.At its core, Bitcoin solved the issue of double spending that had hindered the development of previous digital cash systems.

By implementing a distributed timestamp server and innovative consensus mechanism called Proof of Work (PoW), Bitcoin created a system where transactions are validated and recorded on a tamper-proof public ledger called the blockchain, preventing fraudulent double spending of coins.

This established the foundation for a decentralized currency and global payment network powered by computing nodes rather than centralized intermediaries.

Also Read: What is Consensus Mechanism in Blockchain? 25 Consensus Mechanisms to Choose From

Important Milestones

As the first cryptocurrency, Bitcoin has birthed an entire industry and ecosystem for digital assets and blockchains over the past one and a half decades.

Early technical milestones include the first Bitcoin faucet in 2010 that gave out free coins to spur adoption and events like Bitcoin Pizza Day, where coder Laszlo Hanyecz spent 10,000 BTC (approx. 350 million today) on Papa John’s Pizza in 2010.

Culturally, Bitcoin drew cypherpunks, libertarians, and black and grey market actors in its early days but has seen growing institutional investment and government acceptance recently despite continued volatility.

Average Settlement Time, Fees, and Other Notable Features

Bitcoin facilitates borderless digital payments. At the time of writing, it transferred value with a median transaction confirmation time of 8.5 minutes and an average confirmation time of approx. 88 minutes.

Note: Bitcoin’s actual settlement time depends on several factors including the network hash rate and the fee attached to the transaction. If the fee is low, miners may not prioritize the transaction endlessly.

At present, the average transaction fee is around $13 due to increased network activity. However, this fee typically hovers around $2. Other key features of Bitcoin include a fixed max supply schedule of 21 million BTC, which is expected to reach by the year 2140. Also, 19.5 million bitcoins are currently in circulation.

Bitcoin offers increased privacy compared to traditional finance via pseudonymous addresses that are not directly linked to real-world identities. As the flagship cryptocurrency that gave rise to an entire industry, Bitcoin will always have immense symbolic importance in the crypto-verse even amidst the rise of technically more advanced blockchain networks.

2. Ethereum (ETH)

Market Cap: $248+ billion

Ethereum takes the decentralization and transaction validation principles behind Bitcoin to the next level by also enabling decentralized computing and smart contracts. Proposed in 2013 by Vitalik Buterin and launched in 2015, Ethereum establishes a global platform for decentralized applications (dApps) powered by ether cryptocurrency and built on blockchain technology.

Smart Contracts and Decentralized Applications (DApps)

Unlike Bitcoin's focus on peer-to-peer payments, Ethereum was designed as a decentralized world computer that can run complex software and applications. This is enabled by smart contracts - self-executing code hosted on Ethereum that runs when predetermined conditions are met.

Smart contracts allow developers to build and deploy all manner of decentralized apps (DApps) from games to finance platforms.

Early DApps built using Ethereum include CryptoKitties, which allowed the breeding and trading of unique digital cats and briefly congested the entire Ethereum network at peak 2017 crypto mania! This illustrated early challenges to scalability.

Unique Features and Developments

To fuel its smart contract computations, Ethereum has its native currency called ether (ETH). Ethereum built on the approach of Bitcoin by publishing its whitepaper. However, the platform took one step ahead by issuing tokens in advance to investors, much like companies raising funds via IPOs.

Despite not being the first to do so, Ethereum’s ICO was an immense success and raised about 31,000 BTC in 2014, equivalent to $18.3 million at the time. Unlike Bitcoin's fixed supply and issuance schedule, factors like token issuance, yield to validators, burn rates, and the net change in circulating supply depended on Ethereum’s unique token economics.

Ethereum has innovation deep-rooted into it, with the recent Merge upgrade from an energy-intensive proof-of-work consensus model reflecting its vision.

Settlement Time, Fees, and Ethereum 2.0

Ethereum currently processes 8-13 transactions per second with average confirmation times of 15 seconds to 5 minutes depending on complexity and network activity. Users submit gas fees in ether to prioritize transactions, with current average fees ranging from 16 Gwei ($0.54) to 45 Gwei ($1.67).

Looking ahead, Ethereum 2.0 promises greater scalability, speed, sustainability, and lowered fees through technical upgrades like sharding, wherein we dynamically split the blockchain database into partitions to spread the workload across new validator nodes.

3. Tether (USDT)

Market Cap: $88+ billion

As cryptocurrencies emerged, it soon became clear that their high volatility limited real-world utility and adoption. Enter Tether - launched in 2014, it created one of the first stablecoin cryptocurrencies by pegging 1:1 with fiat currencies like the US dollar.

Acting as a bridge between crypto assets and traditional finance, Tether brings stability to crypto trading pairs.

The Role of Stablecoins in the Crypto Market

Stablecoins like Tether provide shelter from crypto volatility storms. They allow traders to move funds between exchanges without converting to fiat, facilitating faster arbitrage across fragmented crypto trading platforms.

Stablecoins are also used as dollar proxies allowing decentralized finance (DeFi) platforms to offer crypto-backed savings, lending, and derivatives built on blockchain technology.

USD Pegged Value and Stability

Unlike bitcoin and ether with fluctuating market prices, 1 USDT token is always redeemable for USD 1 by Tether Limited.

Strictly speaking, USDT is therefore not truly decentralized as Tether company dollars and reserves back the stable value. Questions have arisen around whether Tether holdings are truly sufficient to honor user redemptions during crises.

Tether has been at the center of controversy due to a combination of factors. Initially, Tether claimed that each USDT token was backed one-to-one by US dollars, but the company faced skepticism as it failed to provide regular audits confirming the adequacy of its reserves.

In 2017, Tether severed ties with its auditor, Friedman LLP, adding to concerns. The New York Attorney General accused Tether and the associated cryptocurrency exchange Bitfinex of concealing an $850 million loss in 2019, leading to a settlement in 2021 requiring an $18.5 million fine and quarterly reserve reporting.

Also Read: The Legality of Launching an ICO in the US in 2023

Tether has also faced allegations of price manipulation, with suspicions that the issuance of USDT without sufficient transparency could artificially influence cryptocurrency prices, further contributing to its controversial reputation in the cryptocurrency ecosystem.

Implementation, Settlement Time, and Fees

Launched on Bitcoin's Omni platform utilizing the BTC blockchain, Tether has in August 2023 announced it will discontinue support for Omni Layer, Kusama, and Bitcoin Cash SLP implementations. It was due to the lack of usage of these transport layers.

According to the Tether, it supports the ERC20 standard via Ethereum, Avalanche, Polygon, and Cosmos blockchains as well as the TRC20 standard via Tron blockchain, both of which collectively contribute more than 99% of its USDT balances.

Tether settlement time depends on the blockchain network you choose. A faster blockchain network such as Solana or Polygon can settle the USDT transaction in 5 to 20 seconds. On average, Tether takes about 1 to 10 minutes to settle.

The same holds for the transaction fee (or gas fee). On average, ETH transfers cost about $2 while settling Tether using Polygon costs just $0.001. Tron settlements range from $0.95 to $2.

Leading centralized exchanges like Binance, Coinbase (on Ethereum blockchain), and Kraken adopt USDT as a base trading pair and settlement currency.

Tether remains controversial but undeniably influential as one of the world's most traded cryptocurrencies.

4. Binance Coin (BNB)

Market Cap: $35+ billion

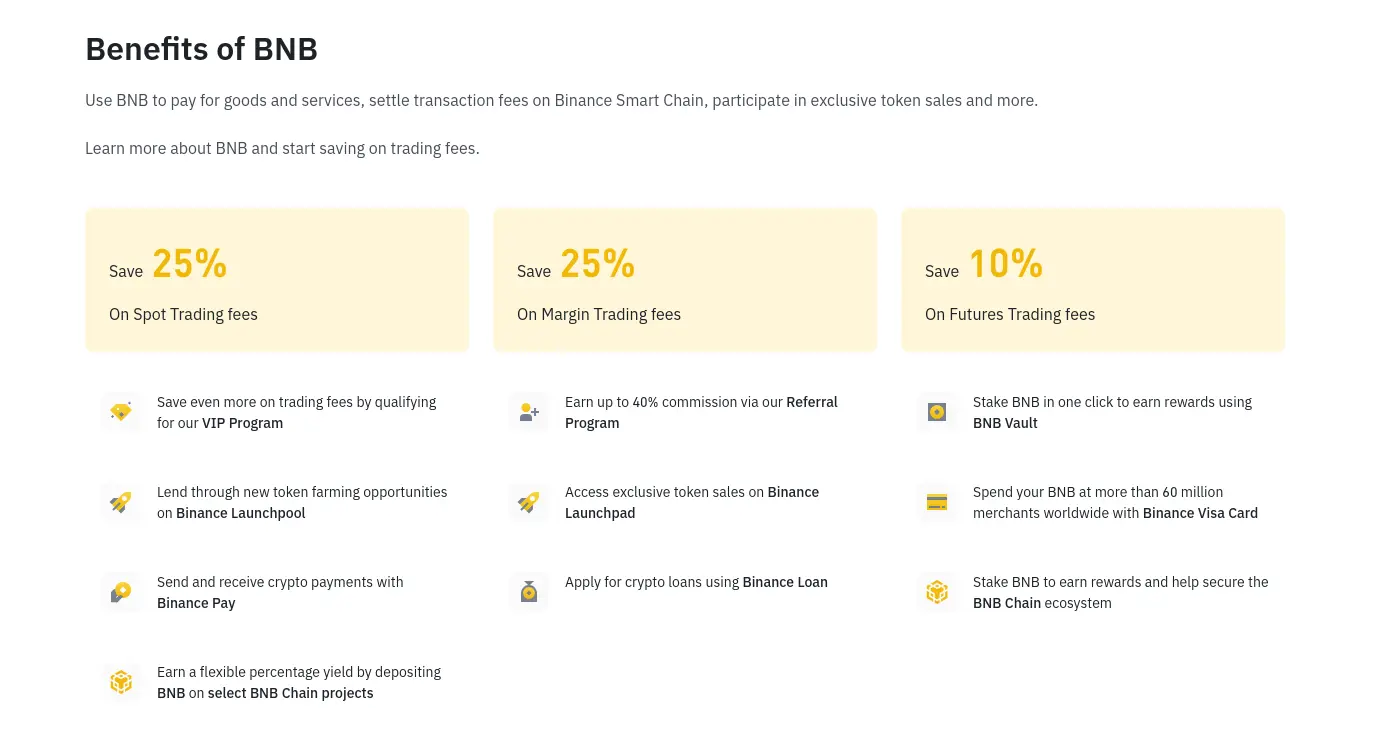

Binance Coin powers the Binance ecosystem as a multi-functional digital asset native to the popular Binance Exchange and wider offerings.

Issued via an initial coin offering in 2017 raising $15 million, BNB provides access to discounted trading fees, platform governance, and more for the world's highest-volume crypto exchange.

Binance Smart Chain and Its Advantages

A key use case of BNB is paying for transaction fees on Binance Smart Chain (BSC) - a speedy EVM-compatible blockchain designed for DeFi app development.

By avoiding Ethereum congestion with low fees of $0,005 and 1-second block times, projects can leverage BSC for scalability. BNB secures the network using a Proof of Staked Authority consensus model.

Use Cases and Adoption

Beyond powering Binance Exchange itself, BNB is increasingly accepted for real-world payments. BNB also facilitates participation in token sales on the Binance Launchpad. Burning BNB also helps drive scarcity and value. All of this, coupled with the fact that Binance is the biggest crypto exchange, drives the value of BNB.

Settlement Time, Fees, and BNB Tokenomics

Leveraging the speedy BNB Chain, BNB transactions settle in under 5 minutes with minimal fees ($0.005) generally. The total BNB supply is limited to 200 million tokens, which will be further reduced to 100 million eventually.

Binance dominates crypto trading, lending BNB’s growing utility.

5. Ripple (XRP)

Market Cap: $33+ billion

Created by fintech company Ripple Labs in 2012, XRP aims to disrupt global financial payments and settlements by enabling near-instant and low-cost cross-border transactions.

XRP leverages distributed ledger technology to facilitate currency trades and outbound liquidity across a network of banks, payment providers, and exchanges worldwide.

Ripple’s Focus on Cross-Border Payments

Unlike cryptocurrencies born from cypherpunk ideals, XRP was conceived within the traditional financial sector specifically for interbank settlements.

Ripple sells XRP token as well as its solutions such as RippleNet (xCurrent, xRapid, and xVia) and on-demand liquidity to banks and remittance firms allowing conversion between fiat currencies, minimizing liquidity costs, and processing times versus traditional players.

Partnerships and Real-world Applications

To date, Ripple has partnered with hundreds of fintech and BFSI players including MoneyGram, Flash Payments, Standard Chartered, Santander, SBI Remit, and American Express to name a few.

Through these and more partnerships, Ripple continues to gain traction for real-world usage cases of blockchain in global payments and remittances. Its solutions offer faster, cost-effective options.

Settlement Time, Fees, and Regulatory Challenges

XRP can theoretically handle 3,400 transactions per second, settling in ~3-5 seconds at fractions of a penny per transaction ($0.0002). However, Ripple has been mired in a few lawsuits from the SEC, which deemed its coin issuance an unregistered securities sale. Currently, Ripple is on a winning streak as the SEC dropped some of these lawsuits while federal judges give favorable judgments for Ripple.

This has limited adoption in the US but Ripple gains traction abroad as payments modernization accelerates.

Also Read: Blockchain 101: How to create your crypto app?

6. Solana

Market Cap: $24+ billion

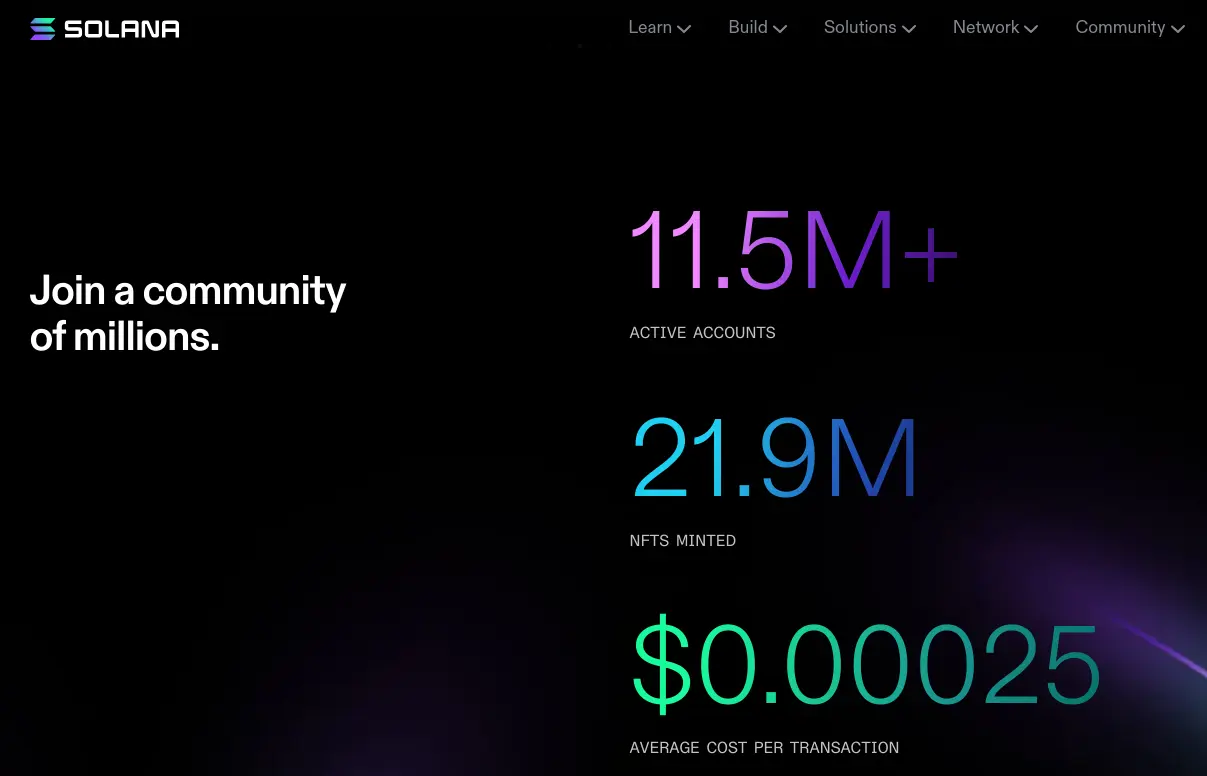

Dubbed one of "Ethereum’s Killers”, Solana prioritizes scalability and high throughput above all else, easily achieving more than 4,300 transactions per second - a staggering speed versus competitors. Released in 2020 by Anatoly Yakovenko and Greg Fitzgerald, Solana leverages 8 core innovations enabling lightning-fast dApps and DeFi.

High-Performance Blockchain and Scalability

Powering Solana’s blazing speeds is a unique Proof of History sequencing combined with Proof of Stake consensus. Computational scaling schemes like transaction parallelization and block pipelining allow throughput magnitudes above legacy chains like Bitcoin and Ethereum. Solana promises the scalability required for global consumer blockchain adoption.

DeFi Projects on Solana

With abundant bandwidth, Solana is emerging as a developer playground for blazingly fast decentralized exchanges, automated market makers, and other DeFi money protocols outpacing the congested Ethereum network. Top projects built on Solana include Secretum (a secure messaging and trading dApp), HDOKI (a crypto-backed entertainment ecosystem), and MetaVersana (a B2E/P2E virtual platform).

Solana’s Settlement Time and Fees

Leveraging proof of history, Solana finalizes transactions in 400 to 600 milliseconds for a paltry $0.00025 per transaction - magnitudes faster and cheaper than Ethereum!

Also Read: What is DeFi? Decentralized Finance Explained

This brings incredible utility, helping decentralized apps and crypto markets scale. Watch for Solana to continue stealing share from Ethereum amidst Web 3 growth.

7. USD Coin (USDC)

Market Cap: $24+ billion

As a leading stablecoin pegged 1:1 with the US dollar, USD Coin combines the stability of fiat currency with the speed and accessibility advantages of crypto. Launched collaboratively in 2018 between cryptocurrency exchange Coinbase and Circle Financial, the management of these regulated financial entities promotes transparency.

Note:While Coinbase is a publicly listed company, Circle Financial is regulated as a licensed money transmitter. In 2021, the latter also applied for listing but received 100 questions from the regulator, ultimately missing its SPAC deadline. Now, it’s planning to go public in 2024.

Role in the Stablecoin Market

Like Tether, USDC facilitates trade between crypto assets across exchanges without off-ramping to traditional banking. $1 USDCs also provide dollar-like capabilities to decentralized lending markets where volatility makes stable value key.

As of late 2023, USDC boasted a $24.5 billion+ market cap ranking 7th largest cryptocurrency overall.

Transparency and Regulatory Compliance

Unlike tether with opaque reserves, USDC reserves are audited monthly with attestations validating 1:1 fiat backing. Issued on multiple blockchains like Ethereum as an ERC-20 token, USDC’s parent company Circle is regulated as a licensed money transmitter under U.S. state law.

Settlement Time and Fees

On Ethereum, USDC transactions get confirmed after approx. 70 confirmations or about 14 minutes. Within fast-finality chains like Solana, USDC payments settle instantly. Tron takes 1 minute (20 confirmations), Polygon takes 5 minutes (250 confirmations), and Arbitrum One takes 15 minutes (40 confirmations).

USDC fee also varies from exchange to exchange. However, they tend to be between negligible (Stellar) to a couple of dollars (for Ethereum).

8. Cardano (ADA)

Market Cap: $13+ billion

Dubbed a third-generation blockchain, Cardano aims to solve problems of sustainability, scalability, and interoperability in crypto by leveraging cutting-edge academic research and advanced protocols. With foundations in peer-reviewed research, Cardano was launched in 2017 by Ethereum co-founder Charles Hoskison through his company IOHK.

Focus on Sustainability and Scalability

At its core, Cardano seeks to create an inclusive and sustainable blockchain ecosystem accessible worldwide using ethical design principles. The protocol runs a unique Ouroboros proof-of-stake consensus minimizing electricity waste from mining while innovations like its Layer 2 solution Hydra enable theoretically infinite scaling through transaction partitioning.

Also Read: What is Layer 2 blockchain? Different types of Layer 2 Solutions

Unique Consensus Algorithm - Ouroboros

Developed using algorithms proven mathematically at leading universities, Ouroboros validates transactions via stake pools rather than power-hungry computational work. This allows decentralized participation in block creation by ADA holders along environmentally friendly lines compared to proof-of-work chains.

Settlement Time, Fees, and Upcoming Developments

Cardano distinguishes itself in the cryptocurrency space by providing efficient settlement times and cost-effective transactions. The platform offers settlement within a remarkably quick timeframe, achieving confirmation in as little as 10 minutes with 15 confirmations. This rapid settlement time is crucial in meeting the demands of users and businesses seeking timely and reliable transactions on the blockchain.

In terms of transaction fees, Cardano boasts a competitive edge with fees as low as approximately $0.07. This affordability contributes to the appeal of Cardano as a practical and accessible option for various use cases, ranging from everyday transactions to more complex smart contract operations.

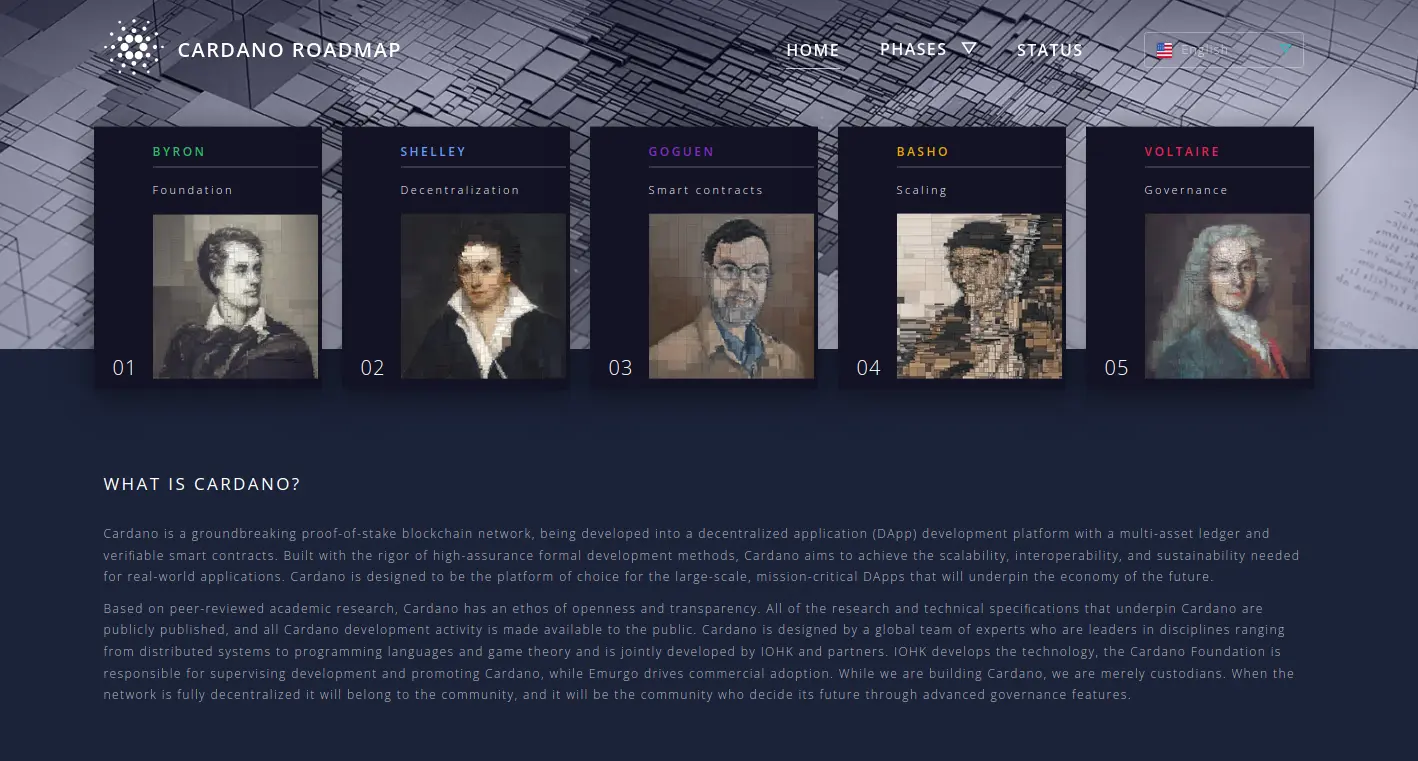

Cardano's development roadmap is a testament to its commitment to continuous improvement and innovation. The roadmap is organized into five distinct eras, each representing a phase of evolution for the platform. These eras are Byron, Shelley, Goguen, Basho, and Voltaire.

Byron: The initial phase focused on the foundation of Cardano, introducing the basics of the network, including its settlement layer.

Shelley: This era marked a significant step forward, introducing decentralization to the Cardano network. Shelley aimed to enhance the security and resilience of the platform by transitioning from a federated model to a decentralized one.

Goguen: Building upon the foundation laid by Shelley, the Goguen era is centered around the integration of smart contracts. This addition expands the functionality of Cardano, allowing developers to create and deploy decentralized applications (DApps) on the platform.

Basho: The Basho era focuses on optimizing scalability and performance. This phase aims to ensure that Cardano can handle a growing user base and transaction volume while maintaining efficiency and reliability.

Voltaire: The Voltaire era emphasizes community participation and decentralized decision-making. This phase introduces a treasury system and a voting mechanism, enabling the Cardano community to actively contribute to the platform's development and decision-making processes.

9. Dogecoin (DOGE)

Market Cap: $10+ billion

Conceived as a parody representing the 2013 cryptocurrency mania, Dogecoin has evolved beyond all expectations into one of crypto’s most recognizable brands. What emerged out of an internet meme now sports a rabid online community and $10 billion market cap after rallying 13,500% in value since inception.

Memes, Community, and Cultural Impact

Dogecoin pioneered leveraging memes and internet culture to attract a grassroots community. An early tipping system allowed thanking strangers for creating or sharing content. Viral moments like raising $30,000 for the Jamaican bobsled team and $55,000 to sponsor a NASCAR racer helped increase the popularity.

Use Cases and Challenges

A fun cryptocurrency more focused on economic accessibility versus advanced tech, DOGE is accepted by merchants like Tesla, Newegg, GameStop, and AMC Theaters.

However, Doge’s lack of development resources for core upgrades poses challenges in the long term.

Settlement Time, Fees, Dogecoin’s Unique Position

With a 48-block transaction finality (or two hours) and a tiny fraction of a penny fees (~$0.0002), DOGE caters more to entertainment than complex smart contracts. As crypto’s most recognizable mascot, Doge keeps wagging its tail flying Dogecoin to the moon!

To Wrap It Up

As we reach the end of our crypto tour traversing the top coins by market capitalization, I hope you've gained perspective into the diversity of blockchain projects seeking to reshape finance, technology, and beyond.

Crypto assets come in all shapes and sizes. While their volatility poses challenges on the road to mainstream adoption, I believe blockchain technology and digital assets are here to stay. As developers drive platform evolution with cutting-edge upgrades, real-world usage continues accelerating year after year.

If you made it this far, pat yourself on the back! With foundations now laid exploring the genesis stories and core capabilities of each protocol, you're well on your way to becoming a blockchain expert.

I encourage you to take a deeper dive with any coins capturing your interest - or get creative dreaming up innovations yet to exist. Cryptocurrency represents freedom: both financial and technological. This industry thrives on visionaries pushing boundaries with daring imagination.

If questions arise during your ongoing crypto journey or you decide to build the next killer blockchain yourself, make sure to or book a 15-minute free consultation call to resolve your queries. Feel free to get in touch!

Frequently Asked Questions

1. Which cryptocurrency is ideal for everyday payments and transactions?

For frequent digital payments and money transfers, stablecoins like USD Coin (USDC) and Tether (USDT) provide stability minimizing volatility risk. Fast networks like Solana and Ripple also facilitate borderless value transfer. You should also keep your local legislation in mind while making crypto-based transfers.

2. I want to develop a crypto token. Where should I start?

Key steps when creating a cryptocurrency include: drafting a whitepaper detailing unique value propositions, choosing an underlying blockchain network and consensus mechanism, programming token issuance/distribution schedules, planning marketing initiatives, navigating regulatory issues like KYC compliance, and more based on specific business needs.

If you need end-to-end guidance on planning, architecture, and launching new blockchain projects safely and legally, schedule a strategy session with Global Blockchain Solution to start bringing your vision to life!

3. Which Cryptocurrency has the highest value?

Bitcoin currently holds the highest market capitalization among cryptocurrencies, but the value of a cryptocurrency can vary based on its unique use case.

For example, if a project prioritizes low transaction fees and quick payments, other cryptocurrencies like Solana or Nano may be more suitable for those specific purposes.

It's crucial to consider the specific features and goals of each cryptocurrency to determine their value in different contexts.