Raising capital can make enterprises feel like Indiana Jones choosing the right Holy Grail. While initial public offerings (IPOs) are a solid standby, newer options like initial coin offerings (ICOs) shimmer with potential when it comes to alternatives to IPO.

At Global Blockchain Solution, our experts have deep knowledge of these golden fundraising chalices. In this article, we will guide you through today's major fundraising mechanisms — IPOs, ICOs, initial exchange offerings (IEOs), and security token offerings (STOs) — helping identify the true Holy Grail for your needs.

Get ready for the traps and treasures of each option so that you can grab the one that yields the greatest fundraising fortune and success for you and your enterprise.

This Article Contains:

What is IPO (Initial Public Offering)?

An Initial Public Offering, commonly referred to as an IPO, is the first time a company offers its shares to the general public. It signifies the company's transition from the relatively closed world of private ownership to the vast, open seas of public trading.

Particularly in the U.S., the IPO journey is guided and monitored by the Securities and Exchange Commission (SEC), which acts as the lighthouse, ensuring that companies navigate this path with transparency and that investors are shielded from potential storms.

How is an IPO conducted?

Taking a company public through an Initial Public Offering (IPO) is a rigorous and multifaceted endeavor that requires precision, due diligence, and strategic planning.

Here’s a structured breakdown of the IPO process in the U.S.:

Selecting an Investment Bank (Underwriter)

The foremost step in going public is to determine the investment bank (also known as an underwriter) to go ahead with. Several factors, including the reputation, IPO experience, research prowess, industry expertise, share distribution abilities, etc. of the underwriter affect this decision.Due Diligence and Regulatory Filings

With the underwriter on board, the next step involves rigorous due diligence. The underwriter investigates the company's affairs, ensuring there are no concealed risks. Key components of this step include:Underwriting Agreements:Various arrangements can be made:

Firm Commitment: The underwriter buys the entire IPO and resells shares.

Best Efforts: The underwriter endeavors to sell shares without guaranteeing a complete sale.

All or None: The IPO is nullified unless all shares are sold.

Documentation:

Engagement Letter: Specifies reimbursement clauses, gross spread, and other financial terms.

Letter of Intent: Outlines the underwriter's commitment and the company's cooperation pledge.

Underwriting Agreement: The IPO is nullified unless all shares are sold.

S-1 Registration Statement: A comprehensive document detailing company information, submitted to the Securities and Exchange Commission (SEC).

Red Herring Document: A preliminary prospectus lacking specific IPO price details.

SEC Review and Marketing Efforts

Post submission of documents, the SEC reviews them for completeness and accuracy. Roadshows, the promotional tours that help underwriters and the company gauge interest from potential institutional investors, must also be performed. They serve as a barometer while setting the IPO price.Pricing the IPO

After securing SEC approval, the IPO price is set based on:Company Valuation: The assessed worth of the company.

Demand Anticipation: Expected demand from the investor community.

Roadshow Feedback: Investor sentiments and reactions from the roadshow.

Market Conditions: Prevailing economic and industry-specific scenarios.

Capital Goals: The amount the company aspires to raise.

IPO Launch

Upon finalizing the price and quantity of shares, the IPO is announced, allowing interested investors to purchase shares on the stipulated date.Stabilization Phase

Post-launch, underwriters can stabilize share prices during a specified 25-day quiet period. During this period, underwriters can intervene to influence prices in the company's favor. SEC rules on price manipulation are relaxed during this period.Transition to Open Market

After the quiet period, the IPO enters the open market competition. The underwriter's responsibility shifts from actively managing the offering to advisory capacities, and market forces dominate the share prices.

The advantages of IPOs

IPO extends a range of advantages to companies. They include,

Massive Capital Infusion

An IPO can unlock vast vaults of capital. Aramco raised a staggering $25.6 billion in its 2019 IPO, the biggest IPO ever held.Enhanced Public Profile

Companies like Tesla, once they went public, found themselves on broader horizons. The elevated profile of being publicly listed catapulted them into the limelight, attracting more attention and innovation.Share Liquidity

Google's IPO in 2004 not only raised a hefty sum but also offered employees and early investors a chance to cash in on their shares, realizing their financial dreams.Acquisition Currency

Amazon has, on multiple occasions, used its high-value stock as an acquisition tool, expanding its dominion.Talent Magnet

APost-IPO, many companies also leverage their publicly traded shares to craft attractive employee compensation packages. Giants like Google and Amazon frequently employ tools like ESOPs (Employee Stock Option Plans) and RSUs (Restricted Stock Units) to retain and incentivize top-tier talent.

Challenges and Legal Nuances of IPOs

There are also certain challenges associated with IPOs that you need to be aware of.

They include:

Complex Regulatory Labyrinth

Facebook faced intense scrutiny and challenges during its IPO. These hurdles demand precision to navigate. SEC can also have enforcement actions against companies on behalf of investors.

Costly Endeavor

Snap Inc.'s 2017 IPO came with an estimated cost of $85 million in underwriting fees, a testament to the significant financial outlay required.Public Scrutiny

After going public, Twitter found itself constantly under the watchful eyes of analysts and investors, with every quarterly report becoming a focal point for its stock price movements.Operational Shifts

Companies like Apple must balance visionary long-term projects with the quarterly expectations of public shareholders—a dance between innovation and immediate value.

What is ICO (Initial Coin Offering)?

Coming straight from the world of decentralized finance and blockchain technology, the ICO is a revolutionary way to raise capital. As an alternative to IPO where traditional shares are exchanged, companies issue tokens in an ICO that can represent anything from equity to access rights in a new project.

ICOs have disrupted traditional fundraising models and paved the way for innovations in financial technology.

Also Read: How to Launch an ICO Successfully in 2023

How is ICO done?

Whitepaper Creation

The whitepaper is the backbone of any ICO. It involves:Clearly defining the project's objectives, potential challenges, and solutions.

Outlining the total amount of tokens to be created, distribution plans, and the purpose of the funds.

Highlighting the team's credentials to instill confidence in potential investors. For instance, when the team behind Ethereum showcased its extensive blockchain experience in its whitepaper, it boosted investor trust.

Token Development

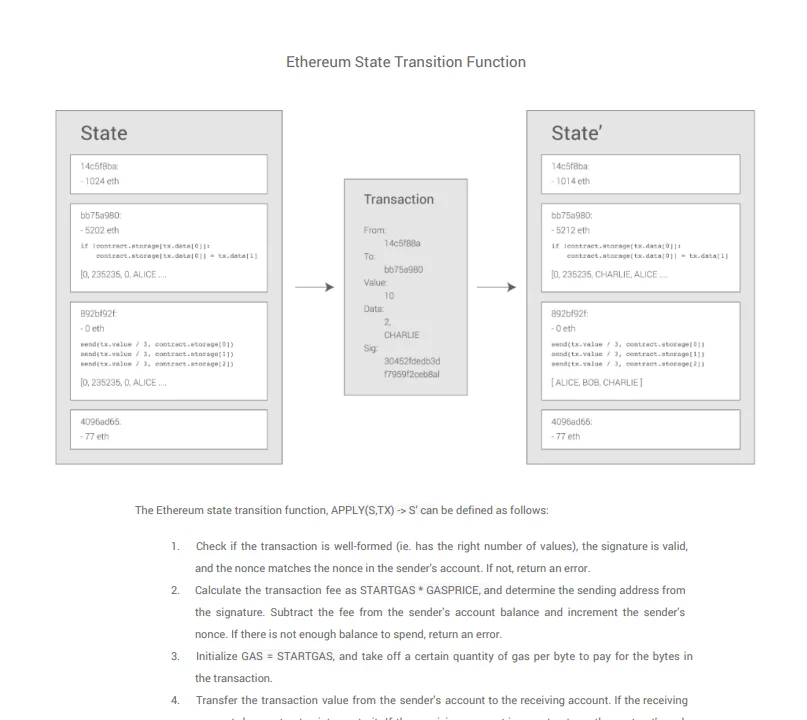

Creating tokens based on established protocols such as Ethereum's ERC-20, ERC-721, and ERC-1155 standards ensures compatibility and security. This approach has been adopted by many successful ICOs to ensure seamless integration with existing blockchain infrastructure.Note: Your token development ultimately depends on your project and what it aims to achieve.

Marketing and Community Building

Engaging with potential investors early and transparently is key. You have to utilize platforms like Telegram, Twitter, and Reddit for community engagement.In this phase, organizing webinars, AMAs (Ask Me Anything) sessions, and attending crypto conferences will help build the desired credibility. A notable example is how EOS leveraged social media marketing and global roadshows to bolster its ICO success.

Token Sale

It's essential to ensure a transparent and fair sale process. You must offer a clear token pricing mechanism, often through a staged approach where early investors might get discounts. Also, providing multiple cryptocurrency payment options for token purchases broadens investor access.Token Distribution

Post-sale, tokens should be distributed promptly and transparently. It's a standard practice to utilize smart contracts to automate token creation, distribution, and resale.It’s also wise to reserve a portion of tokens for the development team, typically locked for a certain period to ensure team commitment. You can also leverage solutions like Ripple's escrow system, where billions of XRP tokens are locked up with a scheduled release over the years.

Project Development

Your ICO isn’t finished with its distribution. You must now use the ICO funds while adhering to everything laid out in your whitepaper.You’ll also have to provide periodic updates on milestones achieved to foster community trust. Ensure feedback loops with early investors and beta testers can guide product development in its nascent stages.

Advantages of ICOs

ICOs equip businesses with a range of advantages:

Wider Investor Pool

The decentralized nature of ICOs makes them accessible to a global audience, thereby potentially increasing the amount of capital that can be raised. EOS managed to raise $4.2 billion in its well-orchestrated, year-long ICO.

Quick Capital Generation

ICOs, if well-received, can lead to rapid fundraising. Bancor raised $153 million in just three hours in 2017.Operational Flexibility

With fewer regulatory constraints initially, startups can iterate and pivot their strategies more agilely.Empowered Community

Early investors often become project advocates, contributing to a project's growth organically.Equity Conservation

ICOs enable businesses to raise capital without diluting their equity. Using ICOs (and other blockchain-based fundraising mechanisms,) they can create complex business structures for their growth and market success.

Challenges and Legal Nuances of ICOs

There are certain challenges while conducting ICOs that also need to be addressed.

Regulatory Uncertainty

While ICOs offer freedom, they are also susceptible to potential clampdowns by regulatory bodies. Tezos faced massive legal challenges after its ICO due to regulatory complications and other discrepancies.High Risk of Fraud

Due to a relative lack of stringent oversight, the ICO landscape has seen fraudulent schemes. Investors must conduct thorough due diligence. For businesses, this creates a sizable challenge in building trust for fundraising.Volatility

Token prices can be highly volatile, influenced by both project-specific news and broader crypto market trends.Potential for Mismanagement

Without traditional oversight, there's a reliance on the project team's commitment and honesty in using funds appropriately. The DAO's mismanagement post-ICO serves as a cautionary tale.

What is IEO (Initial Exchange Offering)?

In the ever-evolving realm of cryptocurrency and blockchain, the Initial Exchange Offering(IEO) has emerged as a successor to the ICO.

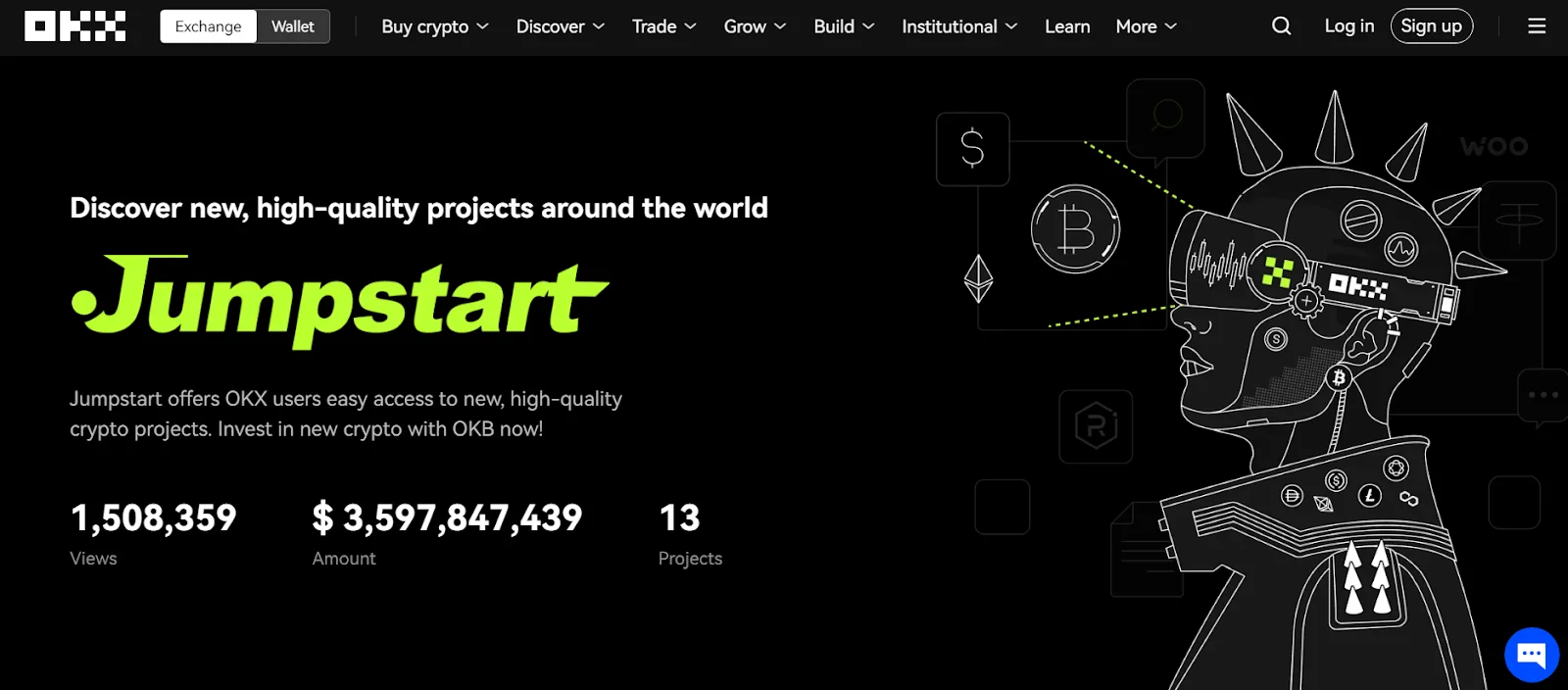

Unlike ICOs, which are open to the public, IEOs are conducted on cryptocurrency exchange platforms, offering a layer of trust, efficiency, and legitimacy to the fundraising process.

How are IEOs conducted?

IEOs share a sizable similarity with ICOs with a few differences.

Here is how IEOs are conducted:

Partnership with a Cryptocurrency Exchange

Before launching an IEO, projects must partner with a cryptocurrency exchange. It's crucial to select exchanges based on their reputation, user base, and past IEO performances. Prominent platforms such as Binance and Bitfinex have successfully hosted multiple IEOs.Thorough Due Diligence

The chosen exchange will conduct rigorous assessments. Evaluating the viability, team credentials, and the project's overall potential ensures quality control. The rigorous vetting by exchanges like Binance for their Launchpad offerings adds a layer of credibility.Token Sale via Exchange Platform

Tokens are directly sold on the exchange platform. Participants usually need to register on the exchange and often need the exchange's native tokens to participate in the IEO. For instance, BNB (Binance Coin) is often used in Binance-hosted IEOs.Immediate Token Listing

One of the significant benefits of an IEO is the immediate token liquidity. Post-sale, tokens are typically listed instantly on the hosting exchange, allowing investors to trade immediately, unlike the often lengthy wait periods associated with ICOs.Continuous Monitoring

The responsibility doesn't end after the token sale. IEO projects should continually update their communities and exchange platforms about development progress, partnerships, and other relevant news.

Advantages of IEOs

IEOs have a range of advantages. They include:

Trust Factor

As exchanges vet projects, there's an increased level of trust among investors. The exchange's reputation is on the line, ensuring only credible projects get the nod.Simplified Investor Experience

Investors typically don't have to manage ICO smart contracts or other complexities. Purchasing tokens on a familiar exchange platform simplifies the entire process.Immediate Liquidity

Quick listing on exchanges post-sale means investors can realize gains or strategically trade without long waiting periods.Enhanced Security

Notable exchanges have robust security protocols, significantly reducing the risks of hacks or frauds, a concern that occasionally plagued ICOs.

Challenges and Legal Nuances of IEOs

However, IEOs aren’t without their share of challenges. Some of them include:

Dependence on Exchange

The project's success becomes intertwined with the hosting exchange. Any negative news or issues related to the exchange can adversely impact the IEO project.Limited Investor Base

Only members of the hosting exchange can participate, potentially limiting the pool of investors.Regulatory Hurdles

While exchanges may vet projects, regulatory bodies worldwide are still formulating their stances on IEOs, leading to potential legal complications in the future. Also, since the regulatory environment is rapidly evolving, and what might be true in one jurisdiction could be different in another.Fees and Costs

Partnering with a top-tier exchange often comes with significant fees, which might be burdensome for startups.

As the world of blockchain financing continues to mature, IEOs present an enticing bridge between the traditional rigor of IPOs and the decentralized allure of ICOs. They reflect the industry's effort to amalgamate the best of both worlds, offering efficiency, trust, and potential rewards for all stakeholders.

But, there is another type of token offering that you should be aware of.

What is STO (Security Token Offering)?

While ICOs took the blockchain world by storm, the regulatory wild west they ushered in begged for a more structured, secure approach.

Enter the Security Token Offering (STO) – a more regulated fundraising mechanism that provides investors with tokens representing a stake in an underlying asset or venture. These are digital representations of traditional securities, binding token holders to equity, dividends, voting rights, or even real estate ownership.

How to do an STO?

As compared to ICOs and IEOs, STOs are more regulated and provide superior credibility to the project initiators.

Here are the steps involved in an STO.

Assessing the Need for an STO

Before leaping into an STO, businesses must assess if their tokens represent a form of security. This is determined using legal standards like the Howey Test in the U.S., which, if satisfied, means the offering is a security and subject to relevant regulations.Regulatory Compliance and Filings

Compliance is the cornerstone of STOs. So, necessary registrations, like the U.S. SEC's Reg D, Reg A , or Reg S forms, need to be completed. This ensures that the offering is in line with securities laws and investor protection norms.Also Read: The Legality of Launching an ICO in the US in 2023

Token Design and Issuance Platform Selection:

The token should encapsulate all features of the underlying security. Platforms like Polymath are tailored for STOs and can facilitate this.Marketing within Legal Bounds

Unlike ICOs, marketing STOs is stricter due to securities regulations. All promotional content, from whitepapers to social media posts, should comply with the rules set out by regulatory bodies to avoid misrepresentation.Token Sale

Investors, often accredited, can purchase the tokens during the STO. These tokens grant them rights or benefits typically linked to traditional securities.Ongoing Reporting and Compliance:

Post-STO, issuers must maintain regulatory compliance by submitting periodic reports, and financial disclosures, and adhering to securities laws pertinent to their jurisdiction.

Advantages of STOs

STOs have several advantages.

They include:

Regulatory Clarity

STOs provide businesses and investors with a clearer legal framework, instilling confidence in the fundraising process.Asset Backing

The token's value is derived from an underlying asset, lending it inherent value and minimizing baseless speculation.Access to Institutional Investors

STOs often attract institutional money, as the tokens are compliant with regulations and offer tangible rights.Global Reach with Compliance

While reaching international investors, STOs ensure adherence to each jurisdiction's securities regulations. Even foreign investors are more likely to invest in projects that have some degree of regulatory supervision.

Challenges and Legal Nuances of STOs

Despite its advantages, STOs are more complex than your average ICOs and IEOs. That’s why most businesses try their best to avoid their asset from being deemed as a security.

Regulatory Complexity

Multiple jurisdictions with varied securities laws can complicate the STO process, demanding careful navigation and legal expertise.

Potential for Overlooked Compliance

Some businesses, while aiming for an ICO, inadvertently step into STO territory without realizing the associated regulatory implications. For instance, some ICOs of the past, which promised future dividends, unknowingly categorized themselves as securities, leading to legal consequences.Higher Initial Costs

The stringent legal and compliance framework means businesses might face substantial initial costs, especially when engaging legal professionals familiar with the blockchain space.Restricted Liquidity

Unlike ICOs, STOs might have holding periods or restrictions on token resale, limiting immediate liquidity for investors.

STOs showcase the blockchain industry's maturation, providing a harmonious blend of regulatory clarity and the revolutionary potential of tokenized assets. Businesses venturing into the STO realm must do so with eyes wide open, being acutely aware of the intricate tapestry of regulations that await.

The promise of STOs lies in their potential to redefine traditional finance, but this innovation comes with its own set of unique challenges.

IPO vs. ICO vs. IEO vs. STO

Conclusion

Navigating the complex landscape of fundraising mechanisms can be daunting for both newcomers and seasoned investors alike. IPOs, ICOs, IEOs, and STOs each offer distinct opportunities, advantages, and risks.

While IPOs remain the traditional route for established companies seeking large-scale public capital, ICOs, IEOs, and STOs have emerged as groundbreaking alternatives, harnessing the power of blockchain technology and catering to a new age of decentralized finance.

Yet, as with any investment, knowledge is power. Ensuring you understand the nuances, benefits, and pitfalls of each method will position you for more informed decision-making.

At Global Blockchain Solution, we're committed to helping you unravel these complexities. If you're left with any lingering questions or simply want to explore the potential of blockchain for your business, don't hesitate. Contact us today and schedule a free 15-minute call with one of our blockchain experts. Together, we can chart the best path forward in this dynamic financial landscape.

Frequently Asked Questions

1. What is the difference between IPO, ICO, IEO, and STO?

IPOs (Initial Public Offerings) are the traditional way of raising funds by listing a company's shares on a stock exchange. ICOs (Initial Coin Offerings) raise funds through new cryptocurrency tokens sold to investors. IEOs (Initial Exchange Offerings) are token sales conducted on crypto exchanges. STOs (Security Token Offerings) offer tokenized securities tied to underlying assets.

2. Is IPO better than ICO?

IPOs allow raising large amounts from the public but have high costs and scrutiny. ICOs are faster, cheaper, and accessible globally but lack regulations.

For established companies needing large, cost-effective public funds, IPOs are generally better. Startups wanting quick capital from crypto investors often prefer ICOs.

3. Is STO better than ICO?

STOs have regulatory clarity, investor protection, and asset-backing, unlike ICOs. However, STOs involve high compliance costs and limited liquidity.

For serious projects wanting credibility of regulations, STOs are better. For innovative startups focused on rapid funding, ICOs may be preferable.

4. Which fundraising mechanism should I choose?

It depends on your project stage, funding needs, target investors, and ability to comply with regulations.

IPOs suit mature companies seeking public investors. ICOs favor early-stage projects targeting the crypto community. IEOs work to gain credibility from an exchange's users. STOs apply to compliant offerings backed by real assets.

Assess your specific requirements and strengths to determine the optimal mechanism. Consulting experts can also help make an informed decision.